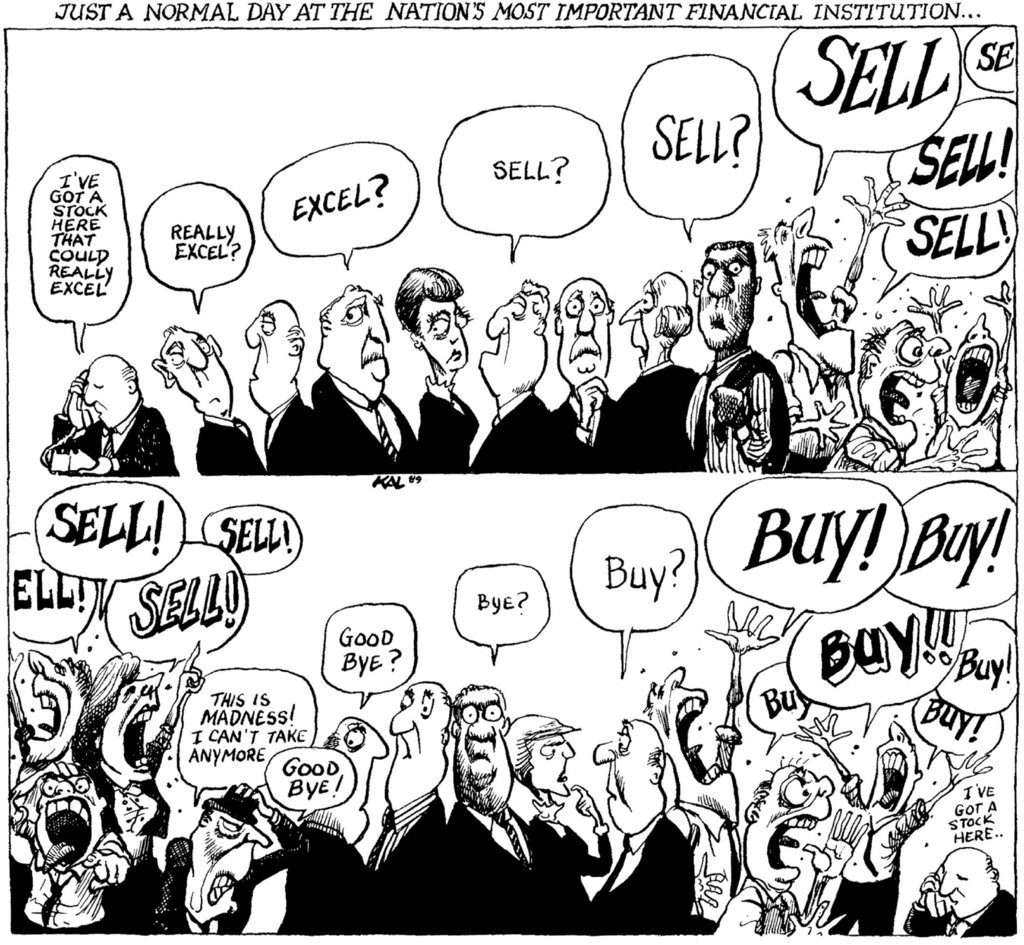

This cartoon in many respects reflects the swings in sentiment as well as the role that fear and greed play in the stock market.

Though it plays a role in the direction of stock it is often not easy for the investor or trader to recognize these extremes in sentiment.

In January and February 2016 the bullish % according to AAII hit the lowest levels since 2005. That combined with the positive technical signs indicated an important market bottom was forming.

There is one technical indicator, the ARMS Index, that does identify most panic selloffs.

It was developed by an old friend Richard Arms. I was fortunate enough to spend three weeks giving presentations throughout Asia with Dick and his wife.

Very high daily levels in the ARMS Index often identify days of panic selling. This indicator was discussed last year in Avoiding Panic Sell Offs.

There have been many sharp declines in this bull market like the one in early 2014. The S&P had dropped 6% since the start of the year and the selling accelerated in early February.

The February 3rd USA Today headline exclaimed “Dow tumbles 326 points” and they noted “investors were clearly afraid”.

The ARMS Index closed at 3.42 on February 3rd and most of the market averages made their lows in the next two days.

The S&P 500 rose over 8% in the next month but unfortunately many sold out on the lows and did not get back in the market.

In my weekend article The Week Ahead: Don’t Let The Euphoria Change Your Plan I urged investors and traders not to ignore the risk now that everyone is so bullish on stocks.

A poor entry price could hurt your portfolio once the market does correct.

Like the other corrections that have occurred in this bull market I expect the A/D line analysis to again warn me in advance of a correction.

As part of my methodical selection of ETFs and stocks to recommend in the Viper ETF Report and Viper Hot Stocks Report the potential risk is a primary concern.

If you are interested in learning more about trading and investing as well as risk analysis I hope you will consider one of my premium services.

Each report is only $34.95 per month and includes two reports each week with in-depth market analysis as well as specific recommendations.

As a bonus new subscribers to either service will receive the following five in-depth trading lessons.

- Managing Risk & Profiting With Starc Bands

- The Most Profitable Candle Formations

- Quarterly Pivot Levels For Trend Analysis

- A Simple But Valuable Tool

- Volume Precedes Price