The blockbuster earnings from Apple, Inc. (AAPL) after the close has pushed its stock to open Friday at $174 which was 3.3% above the pre-earnings close on Thursday. The question for those following the tech heavy PowerShares QQQ Trust (QQQ) the main questions is whether these earnings will be able to push the average to strong new highs.

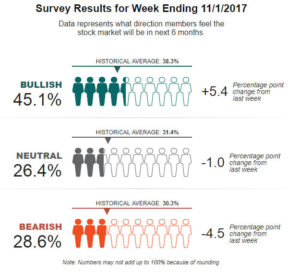

The bullish sentiment on Wall Street is high as some high media traders were arguing whether they should be buying Tesla Inc. (TSLA) as it was breaking support that goes back to late May. The individual investors has apparently changed their tune as in the latest AAII Survey the bullish % rose 5.4% to 45.1% which was the highest reading since January 5th of 2017.

Many bulls are point to this week’s strong economic data and the blockbuster jobs report on Friday as a reason that stocks must move even higher this month. They consider the historically strong performance of stocks in November as another bullish factor. Few seem concerned about the possibility of a November correction.

The Powershares QQQ Trust (AAPL) exceeded its daily starc+ band four out of the past five days. These bands typically contain over 90% of the price activity. The first support is at $149.70 and the rising 20 day EMA. There is converging support, lines a and b, in the $146.20-$147.40 area.

The major advance/decline lines have been positive since the start of September but the Nasdaq 100 A/D line last made a new high on October 20th (point 1) before the latest surge to the upside. The A/D line as of Thursday’s close was still below its flat WMA. A drop below the A/D line support at line c will confirm the short term negative divergence. This would move the A/D line into the short term corrective mode but there are no signs of an intermediate term or weekly top.

A move in the Nasdaq 100 into the corrective mode would be a sign that the earnings from the major technology companies is already factored into the market. By continual monitoring of the major A/D lines I think you will be prepared if stocks should correct in November. If instead Apple Inc. (AAPL) can close strong Friday and continue higher next week it might be enough to push the Nasdaq A/D line to new highs.

In my Viper ETF Report and the Viper Hot Stocks Report, I share my A/D analysis twice each week and give specific buy and sell advice. Each service is only $34.95 per month and can be cancelled on line.