The stock market spent most of the week consolidating its gains after the sharp rally in reaction to the July jobs report. Thursday's sharply...

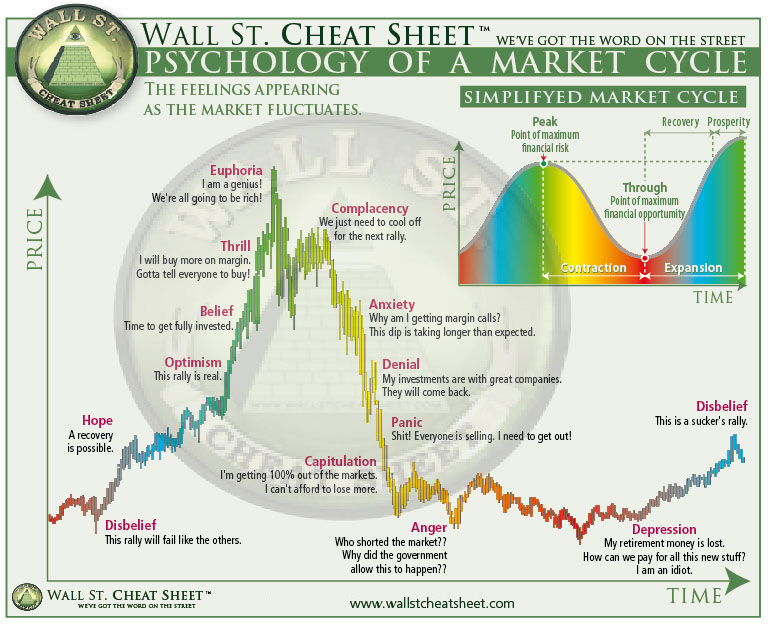

Trading Psychology

The following is a portion of Dennis Gartman’s famous list of trading rules. RULE #1: Never, ever, under any circumstance, should one add to...

by Gary Dayton Traders sit in front of the screen all day watching the markets, and if they don’t see a trade, they may...

I remember it like it was yesterday. Why? Because it was yesterday. The frustrated trader was about at his wit's end. He had been...

The setup looks great. Most of your indicators are signalling it is time to enter. Perhaps one or two don't look perfect, but enough...

When I first watched this video, I was already thinking about how much of it reminded me about mental preparation in trading. Then my...