The Viper Report is launching a Daily Alert Service for futures, stock and option traders.

Subscribe Now Save 30%

Includes the following

- The S&P 500 futures trading system includes new weekly, daily and 260 minute signals plus projected targets & deviation stops. To learn more read Stay With The Trends

- Includes Daily Stocks scan of new optionable stocks that show up on buy & sell list includes Charts of stocks with deviation derived stops

- Weekly Doji Report of stocks that trigger new buy & sell signals that may be the year's winners or losers

In addition to the daily scan and the weekly doji reports, the multiple-time frame analysis of the S&P futures are an integral part of the new service. The signals are generated on weekly, daily, and 260-minute data. The signals are based on a combination of my favorite technical tools along with insights from the sophisticated analysis of the price action.

The learn more about the S&P futures analysis read Tom's initial review of the methodology

Why a daily stock scan? Over the last two years, I have observed that the stocks that show up on my buy scan before the daily close often gap higher the next day, which does not provide a well-defined entry in terms of risk.

There have been many instances where the stock will rally 5-10% in just a few days after a gap higher open. So in order to provide the most timely information to our clients, we're expanding to include daily alerts.

The chart for HII (below) is just one example of how daily alerts can improve your trading decisions.

Huntington Ingalls Industries (HII) stood out on Feb. 24th for trading above its monthly pivot with definitively positive signals from the daily relative performance (RS) and On-Balance Volume (OBV). It closed at $191.99 and the next day it opened higher and closed at $199.86. The following Friday it traded as high as $218.71.

Traders who acted on Friday, February 25 and sold near the highs would have made a 9.5% profit on their trade, but if they had bought near Thursday's close, the profit margin would have been 14%. One day can make a difference.

Subscribe Now Save 30%

The same behavior has been noticed on the short side, as a stock that forms a negative signal, like a doji sell signal on higher volume, will often gap lower on the next day. Those who established a bearish option strategy before the close were often rewarded. But by the next day’s open, a bearish strategy may already be more costly and less profitable.

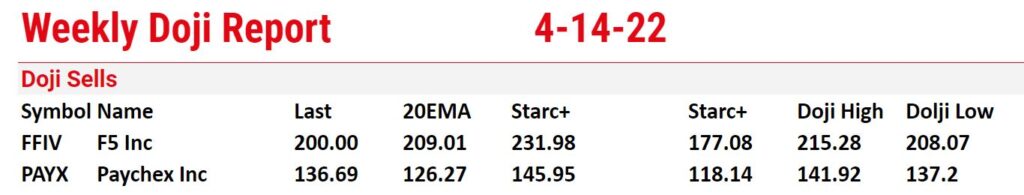

On January 5th I was scanning for doji signals heading into the close and Paychex Inc. (PAYX) showed up having generated a sell signal on increasing volume, with a close of $130.91. The daily RS was declining and the OBV was turning negative heading into the last hour. Three days later, it had a low of $124.62, and after a two-day rally back to the declining 20-day exponential moving average (EMA), PAYX resumed its downtrend. By the end of the month, the S1 support was reached with a low of $109.87.

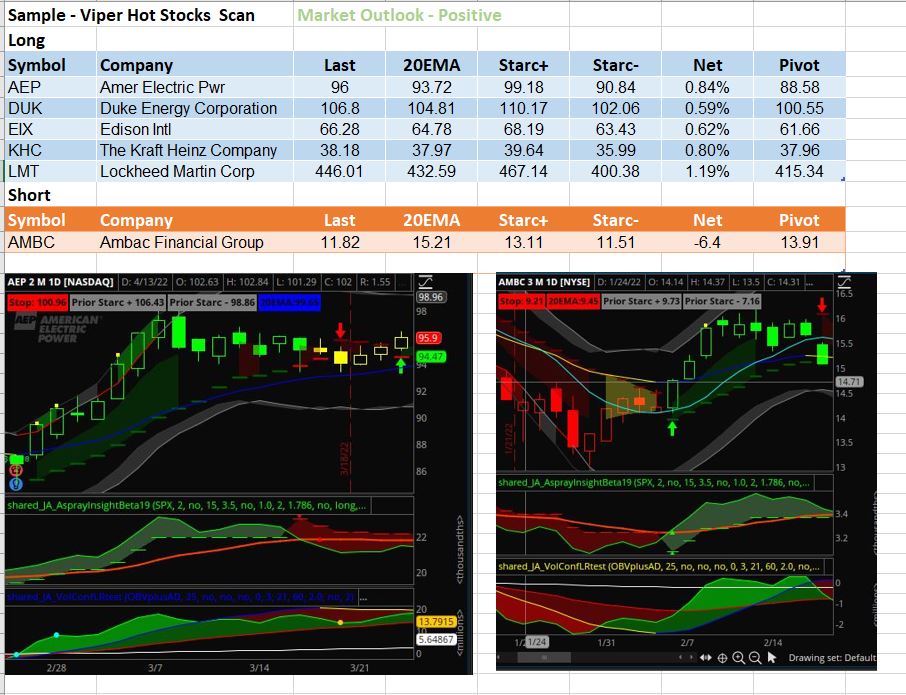

Of course, the market outlook and the trader’s inclination will play a key role in whether you are looking to the long or short side. In our new Daily Alerts, the market outlook will be rated as Positive, Negative or Neutral based on the S&P Futures Analysis and will be updated when there are changes.

Daily reports will be either sent out around 3:00 PM ET allowing one to take a position before the close or right before the market’s open the next day. Reports sent out before the close will be announced on Twitter and StockTwits.

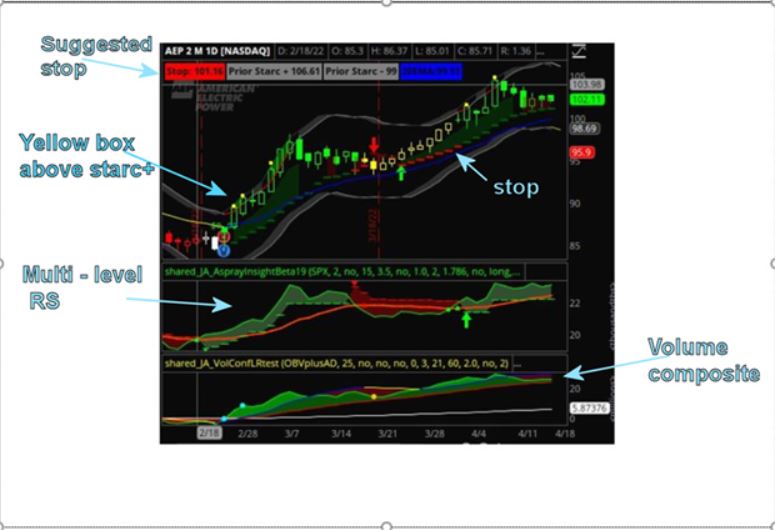

Daily Alerts will include the 20-day EMA, starc bands, and monthly pivot data. When possible, Daily Alerts will also feature TOS charts, including a unique ATR based stop (see below).

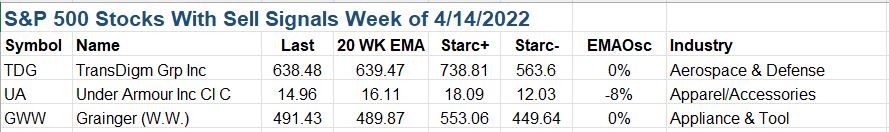

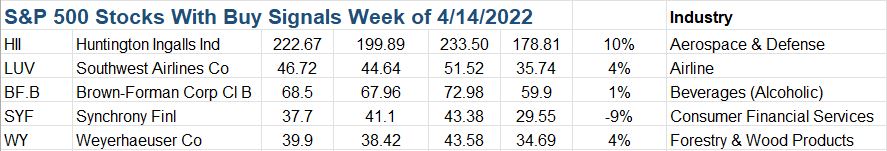

Each weekend you will get a list of those S&P 500 Stocks with new weekly buy and sell signals. Here is a screenshot of the sell and buy list format. The EMAOsc is calculated from the difference between the last price and the 20-week EMA.

Also sent out over the weekend will be the selected stocks with weekly doji sell or doji buy signals. For more on this technique, check out one of my more popular video lessons on YouTube. Subscribers will also receive a written trading lesson with more in-depth instructions.

Subscriptions are offered on a rolling 3-month basis.

The regular price for the Viper Hot Stocks Daily Alert is $255 per three months.

Subscribe For Three Months at $195 - Save 30%

If you have any questions about the service please contact us at Wentworthresearch@gmail.com

Try It For Just One Month - Only $95.00