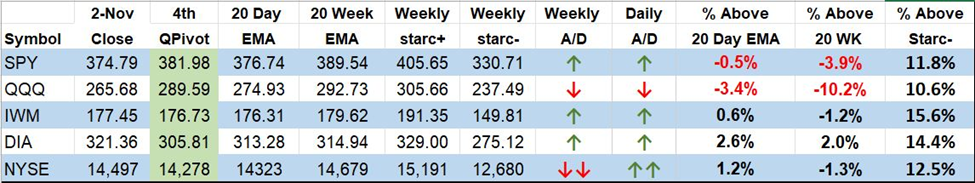

The stock market was as neurotic as ever Wednesday as it put a positive spin initially on the FOMC announcement as stocks rallied. With the press conference, the hopes of “a pivot’ dissolved as stocks plunged with a 3.4% decline in the QQQ.

The A/D numbers were 3-1 negative which was enough to drop the QQQ A/D line barely below its WMA. The action the rest of the week will be important as if the selling continues several weekly A/D lines could flip back to negative. Friday’s job report is likely to keep volatility high.

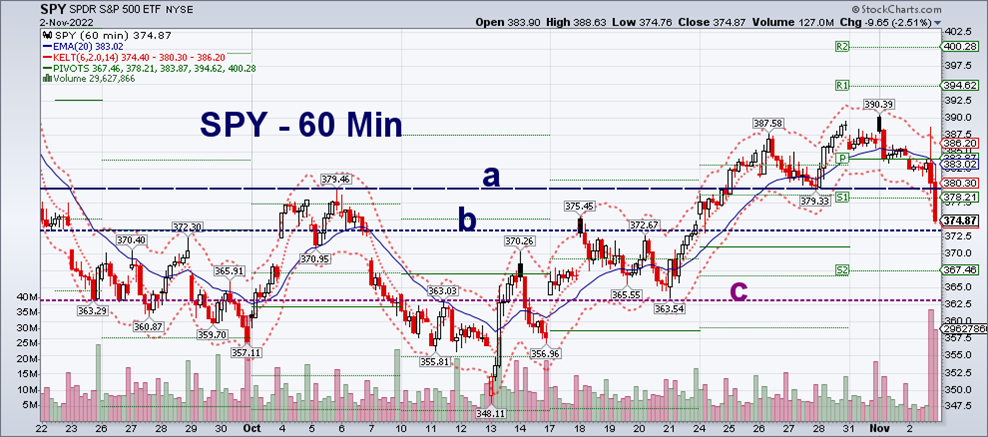

The Spyder Trust (SPY) after a Tuesday’s high of $390.39 reversed sharply to close back below the 100 day MA at $387.70 and the 20 day EMA at $376.74. The pivot at $374.76 is being tested. There is additional support at $370 and $365. The daily S&P 500 has turned lower after closing above its downtrend, line a. The rising EMA and support at line b, should now be watched. The daily NYSE Stocks Only and NYSE All A/D lines have also reversed and are closer to their EMAs after briefly overcoming their resistance levels. The % of S&P stocks above their 50 day MA has dropped to 50% . Now 35.4% of the S&P 500 stocks are above their 200 day MA. The shorter-term measures have turned down from OB levels and the August highs

T

he DIA after exceeding the weekly starc+ band last week and closing 6% above its 20 day EMA dropped less than the other averages down 1.5%. The DIA A/D line was the 1st to turn positive but is still above its rising WMA. The RS is rising sharply as DIA continues to lead the SPY. The NYSE A-D has dropped from +981 to -198.

The iShares Russell 2000 (IWM) was hit hard down 3.3% as it is already close to the pivot at $176.96.

The Invesco QQQ Trust (QQQ) closed well below the 20 day EMA and the pivot at $272.27. The S1 at $259.94 and the daily starc- band could be the next targets. The Nasdaq 100 A/D line closed 1 point below its rising WMA.

The % of QQQ stocks > 10 day MA has dropped from 93% to 42%

Summary: The 2-Year T-Note yield as expected has rallied from support at its 20 day EMA. As long as the yield keeps rising stocks are likely to be under pressure. The R1 and resistance at line a, converge in the $4.74-4.78% area. The 10 Year Yield has not rallied much so far. It would now take a key downside reversal to suggest the rally is over.

In the latest AAII survey investors are becoming more bullish with the % rising to 30.6% up from 20.4% four weeks ago. The bearish % has dropped to 32.9% from above 60% in September. I am not sure this is a positive sign for the short term.

I continue to think that the market will be 5-10% higher by Christmas but the short-term action is more tricky after the downside reversal. I would expect DIA to hold well above the recent lows but QQQ could make new lows. In order to stabilize the market we need to avoid another day of heavy selling on the close this week.

The Asian markets were lower after the action in the US led by a 3% drop in the Hang Seng while the Nikkei and Shanghai Composite were just slightly lower. The Eurozone markets are showing solid losses in early trading.

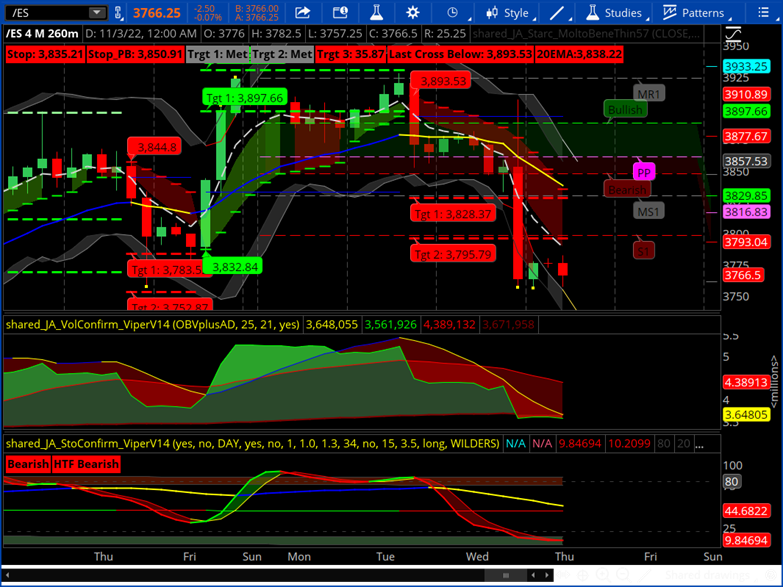

The 260 chart shows the wide range in the futures after the FOMC. The futures were flat a few hours ago now down 30 at at 3738. Both the 260 and daily analysis are negative. The 20 day EMA is declining slightly now at 3786.79 with the some support at 3733. The 260 indicators are negative with the StoConf getting oversold.

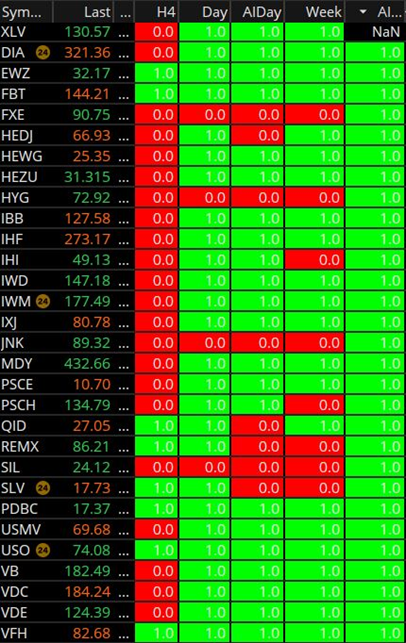

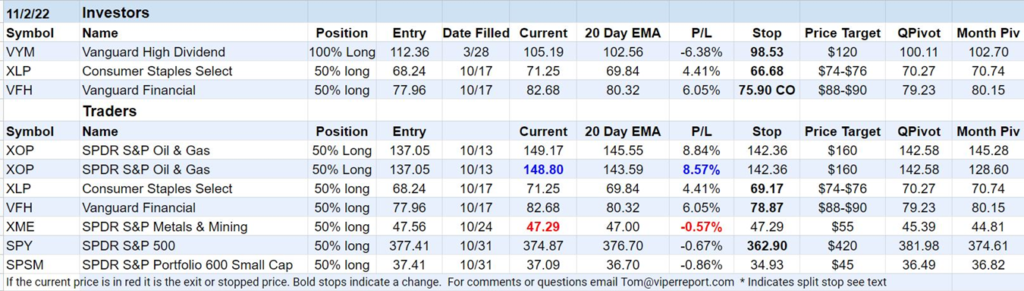

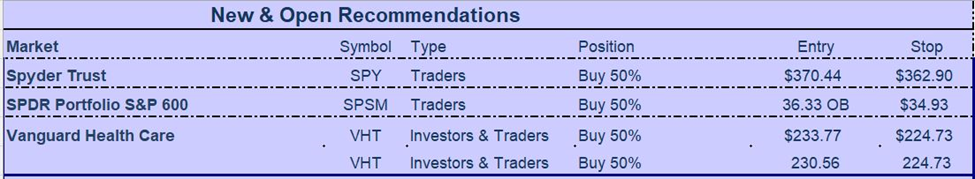

The latest grid shows some of the strongest ETFs like DIA, XLV, XLE, etc turned red based on the H4 analysis but are still positive on the daily/weekly analysis. This is in contrast to XLY the weakest ETF Wed where it is all red. The initial orders for SPY and SPSM have been hit. I have lowered the 2nd buy levels and changed to close only stop for SPY. I am still watching or a soft landing over the next few days to take positions in DIA, MDY, XLI/VIS as well as the biotech ETFs. There is a new recommendation for traders and investors in VHT on a further decline. Sold half the position in XOP Monday which as I explained in today’s report was a tough call Monday. The tighter stop in XME paid off after Wednesday’s reversal. I have new investor and trading stops for XLP and VFH.

SPDR Trust (SPY) – the 60 min chart shows the spike high after the FOMC announcement with a high of $388.63 then the reversal below the support at $379.23, line a. The low was $374.84 just above the support at line b. The weekly S2 is at $367.46. There is a band of support in the $372.67 to $363.50 area, line c. Traders are 50% long SPY at $377.84 or better and add 50% long at $370.44 with a close only stop at $362.90 (risk of 3%)

The SPDR Portfolio S&P 600 (SPSM) has an expense ratio of 0.05%, a yield of 1.58% and assets of $4.1 billion. There are 603 holdings with just 6% in the top ten holdings. SPSM was hit hard late Wednesday with a low of $37.05 after a high of $38.51. The new pivot is at $36.82 with the 20 day EMA at $36.70. The weekly S1 is at $36.63 with stronger support at $36.14, line b. The stop is just under the support at line c, until there are signs the decline is over. The daily indicators are still positive. Traders are 50% long at $37.41 and would now add 50% long at $36.33 with a stop at $34.93 (risk now of 5.3%)

SPDR S&P Oil & Gas Explorations (XOP) crude oil was high Wednesday but is a bit lower in early trading. At the start of the week it was a tough call after a good entry the stop I thought needed to be at $142.36 or lower. I thought $158-$160 was a viable target even though the rally has previously stalled at $155.50, line a. The 20 day EMA is rising at $145.21 with the pivot. The daily RS had dropped below its WMA on Friday before rebounding. The OBV is above its WMA but the fact that the breakout was not impressive made me more cautious. As it turned out XOP traded a shigh at 4152.95 and as low ast 147.75 on Monday. Traders are 50% long at $137.05 with a stop at $142.36 for now. Sold 50% from $137.05 at $148.80.

Vanguard Financials (VFH) pushed to a high of $85.05 then reversed to close at $82.68 The 20 day EMA at $80.32 and the pivot at $80.15 could be tested on further selling. The daily RS looks very strong which means it should stabilize ahead of other weaker sectors. The OBV is not impressive and is just testing the downtrend, line b. Investors are 50% long VFH at $77.96 with a close-only stop at $75.90. Traders are 50% long VFH at $77.96 use a stop at $78.87.

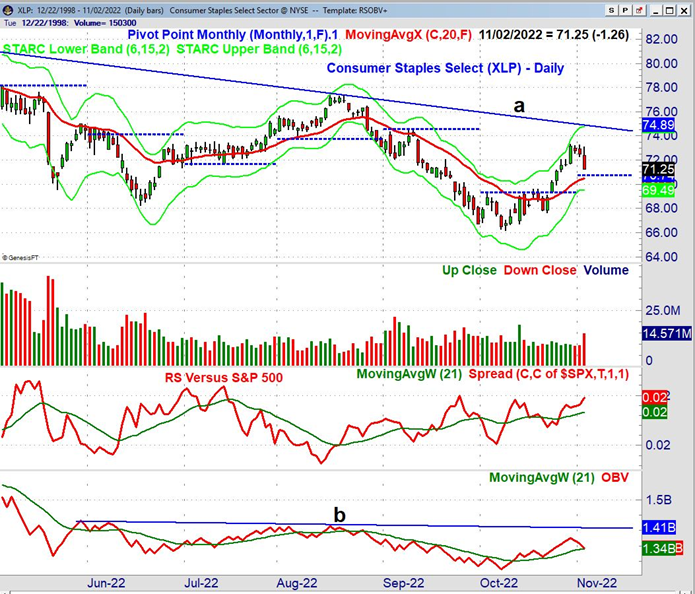

Consumer Staples Select (XLP) is down 2.6% this week as it may be ready to again test the yearly pivot at $70.61. There is also 20 day EMA and monthly pivot support in this area. The daily RS is rising and above its WMA as XLP is declining less than SPY. The OBV is above its WMA but below its resistance, line b. Volume did increase on the reversal. Investors are 50% long XLP at $68.24 with a close-only stop at $66.68. Traders are 50% long XLP at $68.24 with a stop at $69.17.

Vanguard Health Care (VHT) – was down 1.6% on Wednesday after making a new rebound high of $245.71. The 20 day EMA is at $235.63 with the 50% retracement support at 233.10. The QPivot (purple) is at $232.52. which is in between the bullish and bearish zones on Jerry A’s great chart. The rally from the lows was impressive as the volume analysis turned positive for the first time since May. The AID and AIW are also both positive. Investors and traders go 50% long at $233.77 or better and 50% long at $230.56 with a stop at $224.73 (risk of 3.2%)

The SPDR S&P Metals & Mining (XME) traded as high as $50.03 but then closed Wednesday at $46.24. The warning from the slight negative divergences in the RS and OBV last time was on target Traders were 50% long at $47.56 and stopped out at $47.29.

The sharply lower open on Thursday hit the 2nd buy levels in SPY and SPSM. If you would like to start receiving the Viper ETF Report - sign up here just $34.95 per month.

If you are interested in one on one training with Tom email him at wentworthresearch@gmail.com or sign up here for a limited time special offer.

Check out this video