November 7, 2021: The stock market celebrated the encouraging monthly jobs report last Friday. Passage of the infrastructure bill after the close is likely to further support bullish investor sentiment. Despite the record-breaking rally from the S&P 500’s October 4th low, the latest survey by the American Association of Individual Investors (AAII) just 41.5% are bullish compared to the April 7th reading of 56.9%. It is also surprising that 32.5% of investors are neutral on whether stock prices will rise over the next six months.

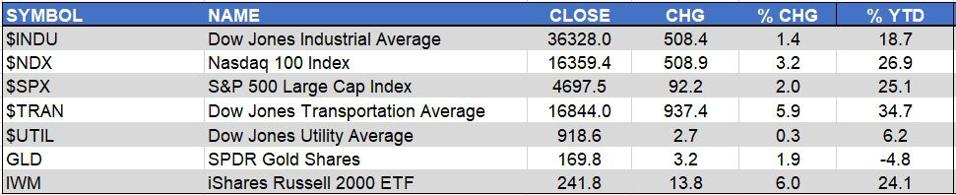

For the second week in a row when all the markets were higher. The iShares Russell 2000 was the top performer up 6% while the Dow Jones Transportation Average was up 5.9%. These gains were in contrast to the 3.2% gain for the Nasdaq 100 Index ($NDX) and the 2% rise in the S&P 500.

The SPDR Gold Shares (GLD)GLD rallied sharply in reaction to the FOMC announcement on Wednesday and closed up 1.9% for the week. GLD is still lower year-to-date (YTD). The YTD gains all improved last week and while a 26.9% performance by the $NDX is impressive it was up 47.65% in 2020 and 38% in 2019. Many may also be surprised to learn that the $NDX was up 102% in 1999.

The Invesco QQQ Trust (QQQ)QQQ which tracks the $NDX moved above its weekly starc+ band for the first time since the week ending September 4, 2020 (point b). Since the starc+ bands were created by the late Manning Stoller to encompass over 90% of the price activity the QQQ is now in a high-risk buy area. That does not mean it can’t go even higher.

In early 2020 (point a) the weekly starc+ band was exceeded for six of seven weeks before the February-March market plunge. Of course, a few weeks of sideways to lower price action would also change the risk profile based on the starc band analysis.

The Nasdaq 100 Advance/Decline line was strong again last week which does favor further gains. The A/D line did drop below its WMA for the week ending October 1st (point c) but the daily A/D lines flipped back to positive before the end next week when the weekly turned back to positive.

Though investors and traders are enjoying the market action based on the latest Bank of AmericaBAC fund manager survey conducted the week ending October 14th these large money managers do not seem to be that positive on the stock market. The survey revealed a “negative outlook for global growth” as their view was the least bullish in over a year.

It was also interesting that hedge funds were reported to have lowered their net equity exposure to 26% down from 41% in September. Those surveyed were even more negative on the outlook for bonds even though 58% saw “inflation as transitory”.

The negative outlook for bonds could be a problem for those managers who are betting on higher yields as my technical outlook for yields has been pointing lower for several weeks. The yield on the 10 Year T-Note dropped 4.6% on Friday to close at 1.453%. The yield is now approaching the support in the 1.453% area, line b. There is additional support at 1.394%, line a.

The MACDs and MACD-His peaked in early October and the divergence at the October 22nd high, line c, indicated that yields were ready to move lower not higher. Both MACDs are declining sharply so a bottom does not seem likely right now.

Many of the analysts from US brokerage firms are raising concerns as they appear to be building up the proverbial “wall of worry” instead of taking it down. With the S&P 500 at 4700, it is already 7% above the highest year-end target of strategists surveyed at the start of the year.

Morgan Stanley’sMS Mike Wilson commented last week that the rally could continue to Thanksgiving but does think there could be a 10-20% correction before the end of the year. Many hedge funds have also cut back on their exposure to risk as the fact that the $NDX has closed higher 16 out of 18 days makes them noticeably edgy. The massive call buying by traders is also a sign of a frothy market and last week traders reportedly spent $51 billion on TeslaTSLA options.

So with large money managers and hedge funds skeptical of the rally what is the next likely scenario?

Throughout most of the summer the lagging action of the NYSE Composite, compared to the Nasdaq 100 ($NDX) or the S&P 500, was a warning of a narrowly based market rally. This view was supported by the NYSE Composite All A/D line that was locked in a trading range.

The trading ranges were resolved on October 20th as the NYSE resistance at line a, as well as the prior highs in the NYSE A/D line were overcome as it staged an impressive breakout. In studying the behavior of the NYSE All A/D line going back over fifty years, the completion of a four-month trading range is a bullish signal for the stock market as we head into the end of the year.

This in my view makes a 10-20% correction very unlikely by year-end. However, the strength of the recent rally and the days of consecutive gains increases the odds of at least a 1-3% correction in the next few weeks.

No matter what is blamed for the correction the selling will need to be heavy enough to briefly shake the confidence of traders while also allowing those market pros on the sidelines to get back in the market. This week we get new numbers on inflation as well as the mid-month reading on Consumer Sentiment.

There are still more stock-picking opportunities where the risk control is much more favorable than in the market tracking ETFs. Both the new stocks that I recently recommended from my October monthly scan pulled back last week but are still above good support. If we do see a sharp market decline it should be a buying opportunity.

If you are interested in learning more about the markets and want specific ETF or stock advice I hope you will consider the Viper ETF Report or the Viper Hot Stocks Report. Reports are released twice a week for only $34.95 each per month.

Tom also offers a wide array of mentoring services and if you want more information please email Tom@Viperreport.com or see the special introductory offer.