The Dow Industrials 234 point decline on Tuesday September 5th convinced some that the market's correction was not yet over. Based on my analysis of the advance/decline lines the sharp market correction was clearly a buying opportunity.

By the market’s close on Friday September 8th my advice to Viper Report clients was that patience was required as new long positions were established on the market's sharp decline. The sharply higher open on Monday September 11th confirmed that the market’s dip was over. The Dow Industrials were up 2.16% last week while the S&P 500 gained 1.58%.

By the market’s close on Friday September 8th my advice to Viper Report clients was that patience was required as new long positions were established on the market's sharp decline. The sharply higher open on Monday September 11th confirmed that the market’s dip was over. The Dow Industrials were up 2.16% last week while the S&P 500 gained 1.58%.

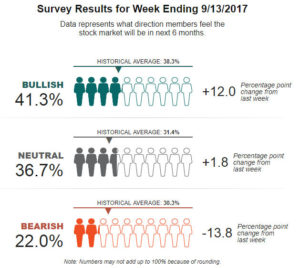

The action last week finally convinced some of the nervous individual investors that they should be buying as according to AAII the bullish % surged 12% to 41.3%. The bearish % dropped 13.8% to 22%.

CNN's Fear & Greed Index closed at 78 on September 15th which was in extreme greed territory. Just a week ago this index stood at 38 which was in fear territory. This sharp turnaround does not invalidate the bullish case for the stock market.

As I pointed out last week’s free Viper Report email I use a combination of methods as well as over thirty years of experience to determine the levels where I will be buying on a dip.

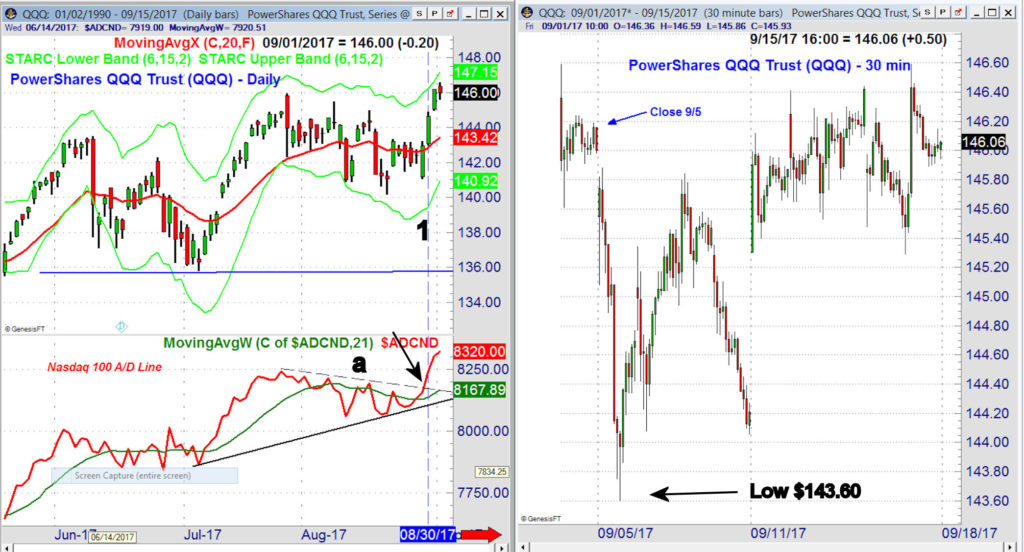

The buy the dip strategy was set up on August 30th, line 1, as the daily chart (on left) shows that the Nasdaq 100 A/D line moved through its downtrend, line a. This confirmed that the correction was over and buying was favored.

The 30 minute chart of the QQQ (on right) shows that it closed Friday at $146. Viper ETF Traders were instructed to go 50% long the QQQ at $144.38 and 50% long at $143.64 with a stop at $138.77.

The low on Tuesday September 5th was $143.60 so both buy levels were hit. The market’s pullback on September 8th held well above the lows and it closed Friday September 15th at $146.06.

Viper ETF traders established in the SPDR S&P Oil & Gas Exploration (XOP) and the Vanguard Emerging Markets (VWO).

Viper Hot Stock traders had made the shift to the long side as the correction was ending. Most of the new signals after Friday’s close were on the buy side. Our new longs in Neflix (NFLX) and Micron Technology (MU) are working out well.

In my Viper ETF Report and the Viper Hot Stocks Report I provide market analysis twice a week along with specific advice. You will also learn about the markets for only $34.95 each per month.