The stock market took another hammering Thursday morning as the weak close on Wednesday reversed the market's early strength which was a sign of weakness. The very strong market internals early Wednesday had deteriorated throughout the day. To signal a sustainable market rally it would be a better sign if very weak early A/D numbers reversed to positive by the close.

In yesterday's Tweet I shared a chart from Viper ETF Report which reveals that as the market has dropped below the January lows the number of NYSE stocks making new lows has been contracting not expanding. The behavior is confirmed by the number of NYSE stocks making new highs as only 3 stocks made new highs on January 20th, there were 37 new highs Wednesday.

This is consistent with a market that is in the process of bottoming but does not signal that it has bottomed. The afternoon buying Thursday and the attempt of the Nasdaq Composite to move back into positive territory was an encouraging sign. The stock index future are sharply higher in early trading as the Stoxx 600 is up over 2%.

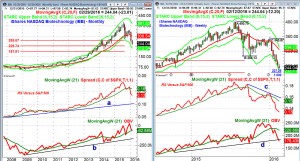

There are some encouraging technical signs that the market is trying to bottom and while some sectors are starting to lead the market it is still not a time to be an aggressive buyer. Other sectors, like biotechnology, continue to be much weaker. The iShares Nasdaq Biotechnology (IBB) is down 27.8% YTD versus just a 10.3% decline in the Spyder Trust (SPY). As a former biochemist I like this sector longer term but from a technical standpoint where might IBB bottom out?

The Spyder Trust (SPY) dropped below the daily starc- band on Thursday with converging longer term pivot support in the $179.18-$180.61 area. The weekly starc- band is at $179.58.

- The SPY approached the declining 20 day EMA Wednesday before turning lower. It is now at $188.21.

- There is stronger resistance in the $190-$192.75 area.

- The S&P 500 A/D line is close to the January lows, line b but needs to move above the resistance at line a, to complete its bottom formation.

- The daily OBV has also not yet made new lows (line d) and now has key daily resistance now at line c.

The monthly chart of the The iShares Nasdaq Biotechnology (IBB)shows that the 38.2% Fibonacci retracement support at $269.67 has been violated.

- This is calculated from the November 2008 low with the 50% support now at $228.74.

- The monthly starc- band is at $212.64 with the 2014 correction low at $207.

- The monthly relative performance did make a new high with IBB in July 2015.

- The RS line is now well below its declining WMA but is now quite oversold.

- The monthly OBV made a new high in December and has now dropped back to its WMA.

- There is further OBV support at the 2015 lows and then the uptrend, line b.

- There is major monthly resistance now at $344

The weekly chart of IBB shows that it has been testing the weekly starc- band for the past five weeks without any bounce but this is likely to change soon.

- Using the decline from the July high to the September low (A>B), the equality target (C) is at $227.25 which is very close to the major 50% support level.

- There is strong weekly resistance now in the $265-$280 area.

- The weekly RS line is still in a clear downtrend as it had a weak rebound in late 2015.

- The RS line has first resistance at the declining WMA with further at line c.

- The weekly OBV could drop below long term support, line d, this week.

- The OBV is still above the late 2015 low.

What to do? Still very ugly action and the dollar top I pointed out last weekend has been confirmed by the action this week. So far it has not been supportive for the stock market but I think it will be before the end of the 1st quarter.

I still am expecting an 8-10% market rebound to get underway in the next few weeks. The technical action suggests that while a very strong rebound is also likely in biotech it may not become a market leader until the second half of the year. The analysis above indicates that the IBB could bottom in the $225-$230 area.

Editor's Note: Traders who like Tom's analytical approach and are interested in trading stocks from both the long and short side might take a look at his Viper Hot Stock report.