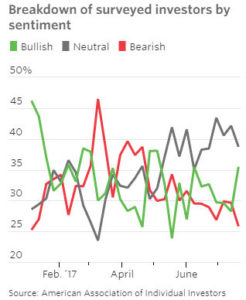

It was another strong week for stocks as the overall positive earnings have sustained the bullish momentum. All the major averages made new highs and the bullish % from the latest AAII survey jumped 7.2% to 35.5%. It had been below 30% for the past three weeks and this is the highest bullish % since May 4th when it was just over 38%.

It appears that individual investors are not the only ones who have missed out on the recent sharp rally. According to a recent Business Insider article the latest survey of money managers by Bank of America Merrill Lynch shows their allocation is 20% underweight in US stocks.

As the article points out this may not be “due to outright bearishness on stocks, but more likely because they see better opportunities elsewhere”. The current period is highlighted on the chart and I have added my own annotation. Even though they manage $600 billion they have missed some major moves.

They were well over 10% underweight (point 1) from the latter part of 2014 though early 2016 when US stock were outperforming the world markets. In early 2016 they moved to overweight US as the S&P 500 was about to drop very sharply.

The money managers have been underweight for the past three months and are still holding a relatively high level of cash at 4.9%. A drop below 3.5% is generally a warning sign and tech sector is no longer their favorite sector.

The powerful rally action has caused many of the stock market bears to turn quiet as I pointed out two weeks ago they had become more vocal as the stock market correction was ending (Correction Lures Bears Out Of The Woods) . They will be back and for those of you who have been following my bullish market analysis over the past year are wondering when they should take profits?

I continue to think that the markets will become more choppy in the coming months. This will make it more difficult for both investors and traders as it will require more decisions. For those who want to reduce their equity exposure when the risk does increase you need to watch the advance/decline line.

Just because the A/D line stops rising it does not mean that there will be a correction that investors need to avoid. Often times after a sharp rally the A/D line will just start to trade in range as the market pauses before it moves even higher.

That is what happened from the middle of December 2017 until January 25th of 2017. Given the incredible burst of bullishness after the election along with the powerful rally in the financial stocks it was time to take some profits in early December and let the market rest.

By December 15th the S&P 500 A/D line had started to move sideways, line 1. On December 30th the A/D line made a low at line b and this then became the important level to watch. If the A/D line were to drop below this low then the A/D would have started a new downtrend which would have implied a deeper correction.

Instead the A/D line bounced back above its WMA in early January and then on January 24th it moved sharply higher, point 1. This was a bullish development as I Tweeted on January 24th

“$SPY $QQQ Positive A/D Mon set stage for todays rally 3-1+ A/D suggests correction over Viper ETF long $XME $QQQ $XLK $IWM may be turning weakness.”

The S&P 500 A/D did again pullback to its WMA in early February before moving sharply higher. If you search for financial headlines from the last ten days of January you will find that a number of analysts had turned negative on stocks. By February 9th the A/D line was accelerating to the upside.

On March 1st the Spyder Trust (SPY) closed above its daily starc+ band and the A/D line made a new high. Though the SPY was in a high risk buy area there were no other signs that the market had made a short term top. The fact that the A/D line had dropped so far below its WMA just three days after the high was a sign of weakness.

On March 12th the SPY rebounded but by then the WMA of the A/D line had started to decline and the A/D just made it back to its WMA. This was a selling opportunity for traders. On the next drop the A/D line declined below the support, line c, that went back to the February lows (point 2). On the next rally the A/D line formed lower highs and then dropped sharply on April 13th.

As I noted at the time there were no divergences at the highs and the fact that the $230 level was holding argued that a deeper correction was not likely. On April 20th, point 3, the A/D line moved through its downtrend signaling that the correction was over.

On Facebook I commented on May 5th “Completion of flag on 4/24 has Mth pivot resistance at $240.91 with minor Fib 1.272 target at $241.49. Measured upside target from flag at $244-$245. S&P 500 A/D confirmed breakout in April now has pulled back to rising WMA.”

The correction in the fall of 2015 and early 2016 was more severe. The S&P 500 A/D line peaked on November 3rd (point 1) and when the SPY made a new high on December 1st the A/D line formed a lower high, point 2. The drop below support, line b, on December 11th started a new downtrend in the A/D line consistent with a further market decline.

The A/D line had a sharp rally at the end of December but it failed to move above the bearish divergence resistance at line a. This was a sign of weakness and set the stage for the plunge at the start of 2016. The A/D line made its low on January 20th and then when the SPY made a new closing low on February 11th the A/D line formed a higher low, line c. This bullish divergence was one of the factors that suggested a bottom was forming.

Three days after the low the A/D line moved above resistance which indicated that the bottom was in place. The bearish divergence resistance, line b, was overcome on March 4th as the weekly A/D line had turned positive at the end of February.

I follow five major advance/decline lines, the NYSE, S&P 500, Nasdaq 100, Russell 2000 and Dow Industrials. It is important to monitor all of the A/D lines as it will help you determine which market sector is likely to perform the best. For the overall market’s trend the broader NYSE A/D and S&P 500 A/D lines are the most important.

The status of the A/D lines are updated twice each week in both the Viper ETF and Viper Hot Stocks Report and subsequently comments are often posted on Twitter or the Facebook Viper Report page. But how can you follow the A/D lines?

The best free site I have found for A/D analysis is stockcharts.com and this chart includes Friday’s close as the S&P 500 A/D line ($SPXADP) made a new high. I have added some of the same trend lines and breakouts I discussed on the earlier chart.

The A/D line is still in a clear uptrend and is well above the rising WMA so there are no signs yet of a correction. The first sign will be when the A/D line drops below its WMA but then the slope of the WMA will need to be analyzed. For a description of how to construct this chart here is a helpful stockcharts guide.

I feel quite confident that the A/D analysis, as it has throughout the bull market, will provide excellent guidance to those investing in market tracking ETFs or mutual funds. Those investors should wait for signs of a correction before they become more defensive.

For those trading or investing in individual stocks one must look at the individual chart patterns using pivot analysis and starc+ bands. The relative performance (RS) analysis can also give traders important information (Traders – Don’t Forget To Take Profits).

The airline sector came under heavy selling pressure last week and many of the airline stocks are releasing their earnings this week. Sometimes when stocks drop in reaction to their earnings it creates a buying opportunity and this was the focus of last week’s article “Should You Buy The Airline Stocks On An Earnings Dip?”.

This week the focus will be on technology as several of the high flying tech stocks including Google (GOOGL), Facebook (FB) and Amazon (AMZN) all report earnings this week..

The Economy

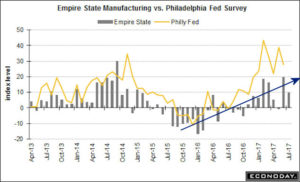

The Empire State Manufacturing and Philadelphia Fed Survey were a bit lower in July as both were weaker than the consensus estimates. As the chart reveals they are both showing a positive trend so it would take several consecutively lower months to change this trend.

The Leading Indicators (LEI) came in at 0.6% which was above the estimate of 0.4%. As I have pointed out on many occasions the LEI has a very good record of topping out well before the start of a recession. This is illustrated in this excellent chart from dshort.

This week the economic schedule is packed with the flash PMI Composite and Existing Home Sales on Monday followed by the S&P Corelogic Case-Shiller HPI, Consumer Confidence and the Richmond Fed Manufacturing Index on Tuesday. The FOMC meeting starts on Tuesday but a change in rates is not likely.

New Home Sales are out on Wednesday, with Durable Goods and the Chicago Fed National Activity Index on Thursday. The advance reading on 2nd quarter GDP and Consumer Sentiment are out on Friday.

Interest Rates & Commodities

The yield on the 10 –Year T-Note declined all week as the rebound in late June failed below the resistance at line a. The steepness of the rally got the market’s attention but as I thought the fears were overdone. The daily MACD turned negative last Tuesday and the short term momentum is now negative. The MACD has formed higher lows, line b, so a drop back to the June lows may be well supported.

The September crude oil contract hit the 20 week EMA at $47.43 last week but then closed lower. The weekly HPI has turned positive but the OBV is still negative. The next good support is in the $44.50 area and this week’s action may be important.

Market Wrap

Even though the Dow Industrials were down 0.3% it was a very good week for stocks with the Dow Utilities up 2.6% followed by a 1.4% rise in the Nasdaq 100. The Russell 2000 was up 0.50% but finally did make convicting new highs for the year. The NYSE A/D numbers were positive with 1881 advancing and 1182 declining.

The Nasdaq 100 was barely lower on Friday breaking its ten day winning streak. The rally since the daily doji and quarterly pivot buy signal on July 7th has been impressive. The upside target as the corrective pattern was being completed is at $145.62 with the upper boundary of the trading channel, line a at $146.57. There is quarterly pivot resistance at $150.83.

Over the near term a pullback looks likely with initial support now at $142.35 and the rising 20 day EMA at $141.05. The daily Nasdaq 100 A/D line turned down slightly last week but is still in a strong uptrend as indicated by its rising WMA. The A/D line had broken out to the upside on July 12th (line c) and it was positive that the A/D line did not make new lows in early July (see arrows).

The weekly chart and technical studies look very strong on the Spyder Trust (SPY). The weekly starc+ band is at $250.62 with quarterly pivot resistance at $252.27. There is good support now in the $244-$245 area along with the 20 day EMA at $244.25.

The weekly S&P 500 A/D line closed at a new all-time high and now has major support at the two year uptrend, line b, and it’s WMA.

The iShares Russell 2000 surpassed the June high last week and the weekly Russell 2000 A/D line also made a new high. It still is an unloved sector if it accelerated to the upside it would catch many by surprise.

What to do? In last week’s column I urged that investors and traders focus on the charts not the earnings. So far it has been quite an earning’s seasons as with almost one-fifth of the S&P 500 reporting 74% have beaten estimates. At this pace earnings could show a 10% gain this quarter.

Over the next few weeks I will be closely watching the sector ETFs to determine if any are starting to lag the S&P 500. The financial sector has dropped back to short term support and needs a strong rally in the next few weeks to stay a market leader.

I continue to believe that while the market action is very strong it is not a good time for investors to be complacent. There have been a number of new weekly buy signals in the country and overseas ETFs. Viper ETFs subscribers will be getting a new report this weekend and traders went long a Euro country ETFs on the recent pullback.

For Viper Hot Stock traders there are a number of great looking charts though I am not willing to chase prices especially if they have not yet reported earnings. Several positions were closed out last week ahead of earnings and while one stock dropped another surged so we gave up some profits.

If you would like to learn more about the markets while you are getting specific buy/sell advice you might consider either the Viper ETF Report or the Viper Hot Stock Reports. For each service you will receive two 4-5 page reports each week along with special updates when the market has a significant decline like on Thursday July 6th. Each service is only $34.95 per month and can be cancelled on line at any time.

For more about my trading strategies you can download a copy of my eBook. This will add you to the email list for the free Viper Reports. I send out market commentary and technical tips several time a week. Additional market comments are often posted on the Viper Report Facebook page.

eft